PV column

energy

2022/08/01

Wholesale electricity prices are skyrocketing in many countries by “Electricity Market Report – July 2022, IEA”

Recently, there have been more and more opportunities to see the news of wholesale electricity price hikes in Japan. In this column, we will introduce an executive summary of the Electricity Market Report – July 2022 update, and “Wholesale prices” in the report.

(Conversion, Japanese version only)

The EURO amounts in the original report are converted to Japanese yen using the average exchange rate of 138.0 yen to the EURO in July 2022.

Source: Based on IEA “Electricity Market Report – July 2022” https://www.iea.org/reports/electricity-market-report-july-2022/executive-summary and https://www.iea.org/reports/electricity-market-report-july-2022 All rights reserved; as modified by Europe Solar Innovation Co., Ltd.

*****

Executive Summary

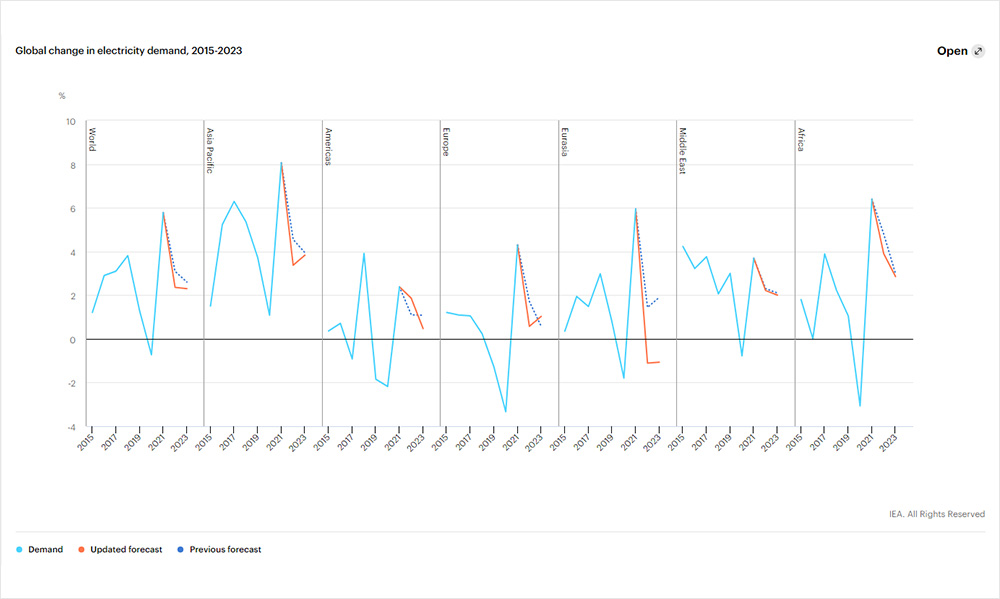

Electricity demand growth is slowing significantly in 2022. After global electricity demand grew by a strong 6% in 2021, propelled by rapid economic recovery as Covid-19 lockdowns eased, we expect growth to slow to 2.4% in 2022 – about the same as the average from 2015 to 2019. This reflects slower global economic growth, higher energy prices following Russia’s invasion of Ukraine, and renewed public health restrictions, particularly in China.

Tight natural gas markets are favouring coal-fired power plants. Due to high gas prices and supply constraints, coal is replacing gas for power generation in markets with spare coal plant capacity. In Europe, governments delayed coal plant phase-outs and lifted restrictions to increase the availability of coal generation, thereby reducing gas consumption to improve security of supply.

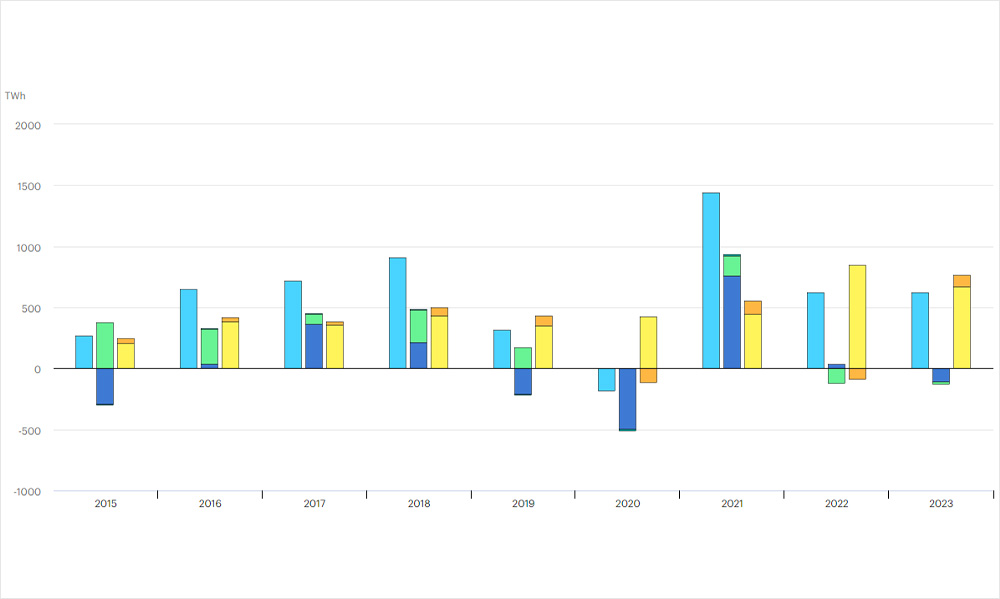

Renewables are growing faster than demand and replacing fossil fuels. Strong capacity additions are helping global renewable power generation towards growth of more than 10% in 2022. Despite nuclear’s 3% decline, low-carbon generation is set to rise by 7%, resulting in a 1% drop in total fossil fuel-based generation. Globally, coal power increases slightly as declines in China and the United States are balanced by growth in Europe. Gas power falls by 2.6% as growth in North America and the Middle East offsets some of the decline in Europe and in Central and South America.

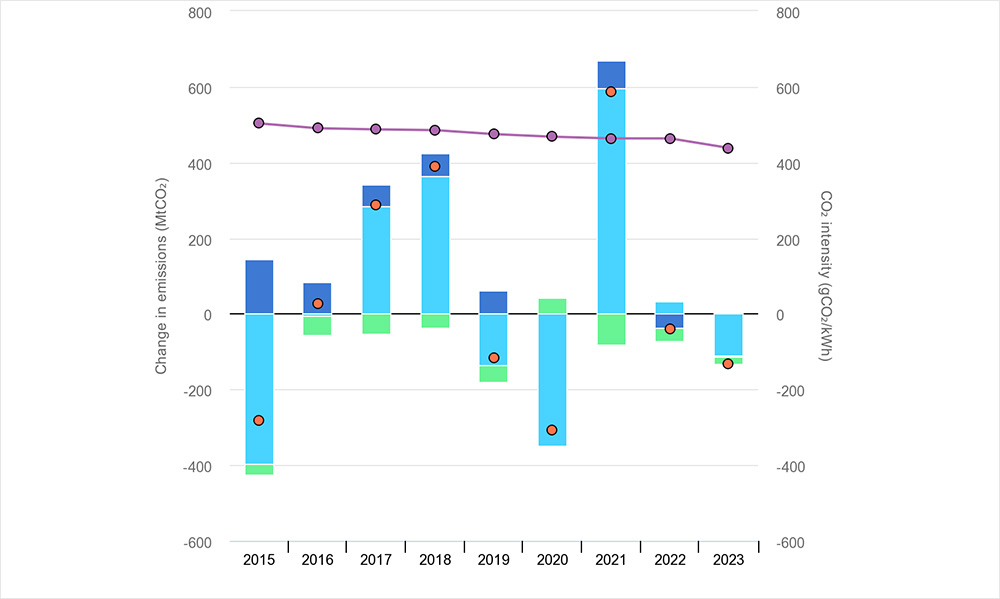

Electricity sector emissions are set to decline slightly. After having risen to an all-time high in 2021, CO2 emissions from the global electricity sector are set to decline in 2022, albeit by less than 1%. Emissions intensity is set to fall by more than 2%.

Wholesale electricity prices are skyrocketing in many countries. In the first half of 2022, gas prices in Europe rose fourfold and coal more than threefold from the same period in 2021, resulting in wholesale electricity prices more than tripling in many markets. Our price index for major global electricity wholesale markets reached levels that were twice the first-half average from 2016 to 2021.

Europe is gearing up to reduce its reliance on Russian fossil fuel imports by accelerating its clean energy transition. The implementation of the European Commission’s REPowerEU plan would greatly accelerate deployment of renewables in the coming years, doubling their share in EU gross final energy consumption from 2020 to 2030 and significantly reducing fossil fuel use. The continued energy price crisis is fueling debate on wholesale electricity market design, while governments are trying to cushion high electricity prices with diverse support schemes.

Large uncertainties for 2023. The main uncertainties affecting our 2023 forecasts for electricity demand and generation mix concern fossil fuel prices and economic growth. As of mid-2022, we expect global electricity demand growth in 2023 to remain on a similar path as this year. Strong renewables growth of 8% and recovering nuclear generation could displace some gas and coal power, resulting in the electricity sector’s CO2 emissions declining by 1%.

Graph 1: Global change in electricity demand, 2015-2023

Graph 2: Evolution of global electricity demand, fossil fuel and low-carbon electricity generation, 2015-2023

Source: IEA analysis based on data from IEA (2022) data from the IEA (2022), Data and statistics. All rights reserved; as modified by Europe Solar Innovation Co., Ltd.

Graph 3: Global change in electricity emissions by source and emissions intensity, 2015-2023

Source: IEA analysis based on data from IEA (2022), Data and statics. All rights reserved; as modified by Europe Solar Innovation Co., Ltd.

*****

The following is our translation (Japanese version) and excerpt of the wholesale electricity market prices (pages 26-29) from the full-report (total 62 pages) available for download.

Source: IEA Electricity Market Report July 2022 -Update All rights reserved; as modified by Europe Solar Innovation Co., Ltd.

Electricity prices in many wholesale markets continue to be on the rise…

Wholesale electricity prices rose significantly in many countries in the first half of 2022, especially in Europe, pushed up by tight fossil fuel markets. Our price index, representing a four-quarter rolling average of weighted prices in major electricity markets, reached almost 300 points in the second quarter of 2022, indicating three times higher average wholesale prices than in the reference period in 2016 and 60% higher prices than in the same quarter of 2021.

In many European markets, wholesale power prices in the first half of 2022 were three to more than four times as high as the average in the first half of 2016 to 2021, primarily due to gas prices climbing to more than five times the value of the reference period. In Germany, average baseload prices reached EUR186 (JPY25,668)/MWh. Carbon prices also increased significantly – up by 90% in the first half of 2022 compared to the same period in 2021, averaging EUR84 (JPY11,592)/t CO2 – but made a minimal contribution to the electricity price increase. In Spain, wholesale prices declined with a cap on gas prices for power introduced in June. The real costs of electricity are however not fully visible as gas plants have to be compensated.

Based on electricity futures, we expect power prices in Europe to slightly decline during the Northern Hemisphere’s summer, then peak in the winter 2022/2023. In France, due to low expected nuclear availability, future prices as of early July 2022 show baseload prices exceeding EUR800 (JPY110,400)/MWh for the winter quarters of 2022/2023 – with peak load prices of more than EUR1,400 (JPY193,200)/MWh.

In Nord Pool, average wholesale prices for the first half of 2022 were 2.7 times those of a year earlier. While prices rose to EUR115 (JPY15,870)/MWh, they remained significantly below the European average due to the high share of hydro-based generation.

The average wholesale price in the United States in the first half of 2022 was lower than in the first half of 2021 (supply disruptions in Texas in February 2021 made prices surge). In the second quarter of 2022, average wholesale prices rose by 130% year on year. Gas prices (more than 150% higher year on year) are the main driver.

Japan was confronted with a tight supply situation in January 2021 and accordingly very high electricity prices. In the second quarter of 2022, average prices doubled year on year, caused by a mix of higher prices for both coal (up 150%) and gas (up 90%).

In Australia, wholesale prices rose by 144% in the first half of 2022 (year on year) due to higher gas prices (at the East coast plus 65%), higher temperatures and lower availability of thermal plants. Trading in Australia’s spot National Electricity Market was suspended from 15 to 24 June 2022, amidst generation shortfalls that made it “impossible to operate” under the usual market rules.

In India, wholesale prices soared since March 2022, as higher power demand outpaced coal availability, leading to severe power shortages. The average price almost doubled in the first half of 2022 year on year, reaching a record high in more than a decade.

High natural gas prices are main driver for increasing wholesale electricity prices in Europe

Soaring fossil fuel prices on global markets resulted in very high electricity prices. High costs for natural gas are a main driver, as gas-fired plants frequently set the wholesale electricity price in Europe. In addition, carbon prices in Europe have risen markedly since 2021, sparking discussions around their contribution to the electricity price increase.

In June 2022, EU ETS allowances prices were over three times higher than in January 2020. Despite the significant increase, carbon costs remain a minor contributor to total gas-fired generation costs. In January 2020, they accounted for about 30% of total costs; as gas prices rose by over eight times during the period, that share dropped to below 15% in June 2022. Overall, 90% of the cost rise from January 2020 to June 2022 reflects the higher gas price and only 10% is due to the increase in carbon prices.

European carbon prices rose due to several factors. One major driver is gas-to-coal switching induced by high gas prices. With coal power CO2 emissions being about twice as high as gas, this boosted demand for emissions allowances. In parallel, proposals for more ambitious emissions reduction targets for the EU ETS, from currently 43% to 61% (European Commission) or 63% (European Parliament) by 2030 compared with 2005, led to an anticipated lower allowance availability. In turn, the worsening economic outlook and the proposal to increase the amount of auctioned allowances in the REPowerEU plan had price-dampening effects.

*****

Please refer to the IEA website (www.iea.org) for energy-related statistics and various reports and articles.