PV column

Solar modules

2022/03/21

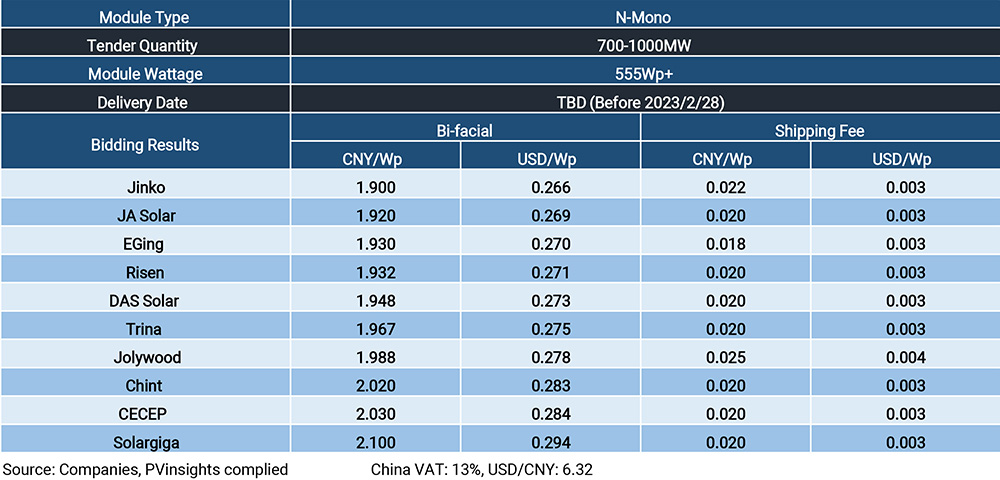

PV module bid result in Chinese Market (USD 0.266/Wp)

Though PV medias and many news were released about PV market trend other than Japan, the major languages are mostly local languages or English. This time, I would like to introduce the news of PV module large scale bid in China, the No. 1 PV market in the world.

PV Insights, as the world-class PV media, released their article dated March 10, 2022 about the Bid result of CNNC Rich Energy (subsidiary of China National Nuclear Corporation) dated March 9, 2022. The Japanese version was translated by Europe Solar Innovation. Please visit PV insights or this our English website about the original English version.

Jinko Bid at the price of USD 0.266/Wp to the N-Mono module with 555Wp+ in CNNC Tender, narrowing the price premium to Mono PERC one

March 10, 2022

On March 9, CNNC Rich Energy released the bidding result of its 700MW to 1000MW of bi-facial N-mono modules with wattage over 555Wp, while Jinko bid the lowest at the price of CNY 1.9/Wp or USD 0.266/Wp, while JA Solar and EGing came after with CNY 1.92/Wp or USD 0.269/Wp and CNY 1.93 or USD 0.27/Wp, respectively. Jinko’s bidding price with DDP term was 1.922/Wp, or USD 0.269/Wp in total with solar module and shipping costs, but still much lower than the lowest price CNY 2.03/Wp seen in the SPIC’s N-mono module tender with DPP terms in late January. The aggressive bidding price of Jinko showed its determination of promoting N-mono modules and its superior cost capability of limiting the price premium to mono PERC ones within CNY 0.1/Wp or USD 0.015/Wp. While other participants also bid lower than in the previous tender even after weeks of material cost rises, the result signaled that the competition in N-mono module market is heating and the price premium could further narrow.

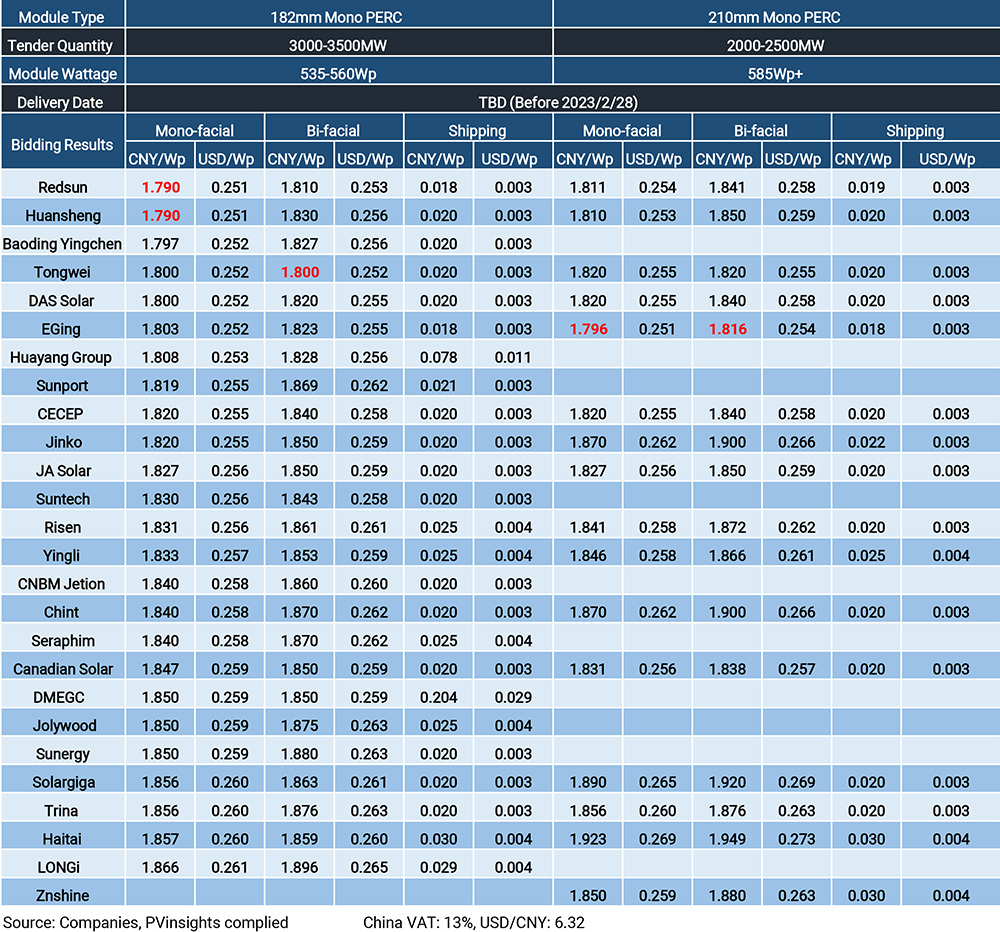

CNNC Rich Energy also released the result of its 6GW to 7.5GW solar module tender that composed of four sections, with the section 2 and section 3 asked for 3GW to 3.5GW of modules with 535-560Wp and 2GW to 2.5GW of modules with wattage over 585Wp respectively. Considering the required wattage, section 2 may preferred 182mm 72pcs modules, while section 3 may favored 210mm 60pcs or 66pcs modules. According to the results, Redsun and Huansheng bid the lowest for mono-facial modules in section 2 with CNY 1.79/Wp or USD 0.251/Wp, while Tongwei offered the lowest bid at CNY 1.8/Wp or USD 0.252/Wp for bi-facial modules. In section 3, EGing bid the lowest prices in both mono-facial and bi-facial modules with CNY 1.796/Wp or USD 0.251/Wp and CNY 1.816/Wp or USD 0.254/Wp respectively. The result showed that the prices of 182mm mono-facial modules falling back under CNY 1.8/Wp again, signaling that the oversupply pressures in the market continued to grow amid aggressive supply and tepid demand growth globally, while 210mm modules can enjoyed a premium around CNY 0.1/Wp against 182mm ones due to rising adoption cases globally and relatively tight supply.